cash flow diagram calculator

What percentage of sales will be spent on the products you sell. Use this calculator to help you determine the cash flow generated by your business.

Hp 12c Financial Calculator Internal Rate Of Return Hp Customer Support

Firstly determine the net income of the company from the income.

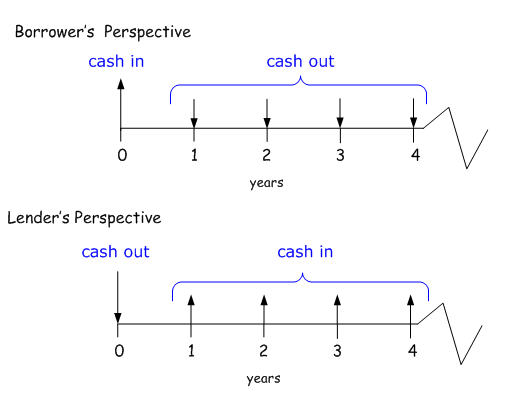

. The chart gives you a peek into your past present and future cash flow. Factors that are important to achieve an accurate result on a calculator are. That is important because while cash flow pressures are reduced by the fact of the loan the price for that is perceived greater exposure to the debt that is keeping the business afloat.

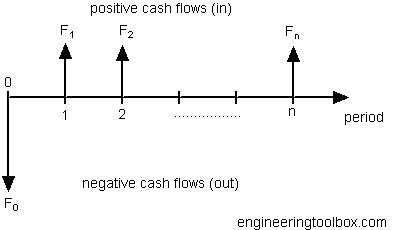

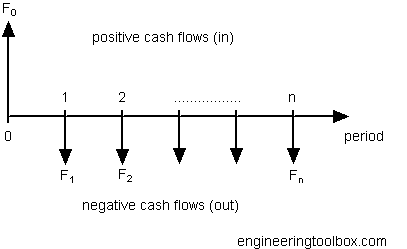

It shows the cash that a company can produce after deducting the purchase of assets such as property equipment. Single Payment Present Worth. Choose ONE formula from the following list.

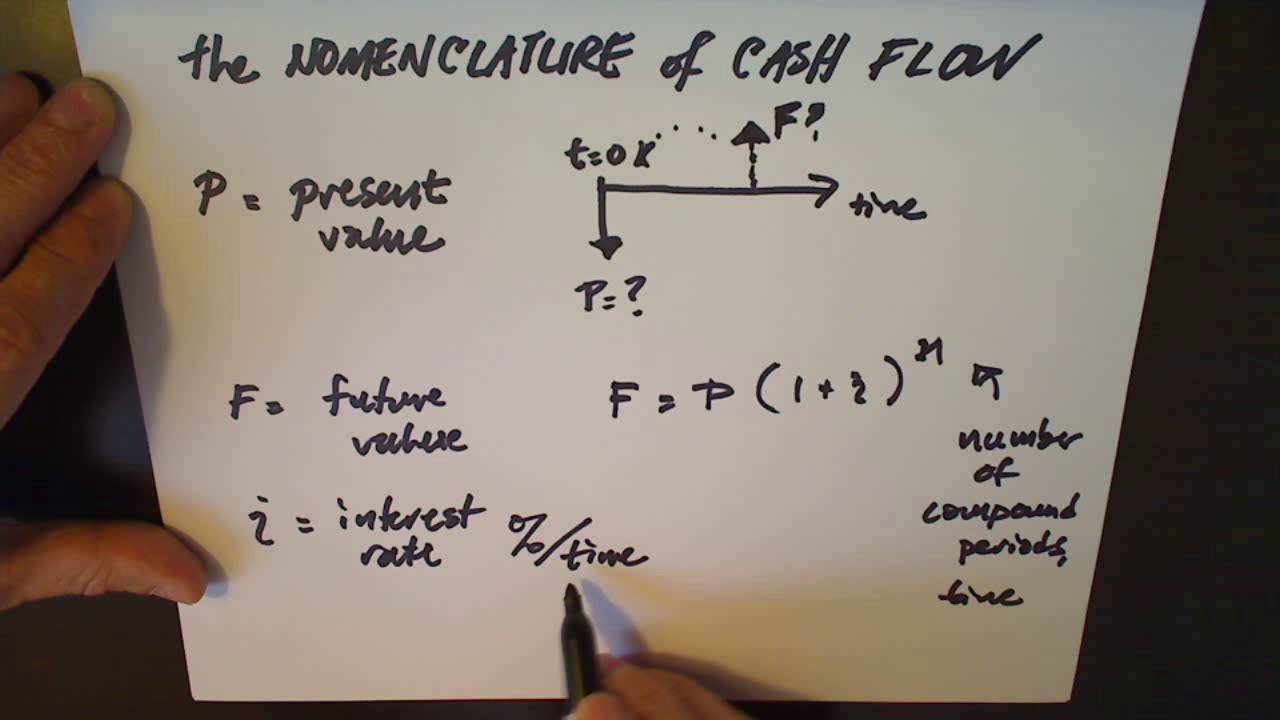

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. Interest rate or discount rate per period - While using iCalculators calculator you have to enter the expected interest rate. It is a method of looking at a businesss cash flow to see what is available for distribution to the securities holders of a corporate entity.

Use this calculator to determine if the money coming into your business ie. Cash borrowed by a company from a director or any other source will improve net cash flow but at the same time show an increase forecast borrowings. A payment of 23000 is due today.

Operating Cash Flow Operating Income Non-Cash Charges Change in Working Capital Taxes. If you run out of available cash you run the risk of not being able to meet your current obligations such as your payroll accounts payable and loan payments. Once it is opened you can put your data in sheet and then.

Use this calculator to determine if the money coming into your business ie. PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet. While free cash flow gives you a good idea of the cash available to reinvest in the business it doesnt always show the most accurate picture of your normal everyday cash flow.

If a company has an operating income of 30000 5000 in taxes zero depreciation and 19000 working capital its operating. The formula for free cash flow can be derived by using the following steps. Payroll and other expenses for a set period.

Use this calculator to help you determine the cash flow generated by your business. Single Payment Compound Amount. By changing any value in the following form fields calculated values are immediately provided for displayed output values.

Free cash flow FCF measures a companys financial performance. Discounted cash flow DCF Sum of cash flow in period 1 Discount rate Period number. In corporate finance free cash flow FCF or free cash flow to firm FCFF can be calculated by taking operating cash flow and subtracting capital expenditures.

Click the view report button to see all of. By changing any value in the following form fields calculated values are immediately provided for. Unpaid invoices bills and other forms in QuickBooks that are due in the future.

CASH FLOW DIAGRAM Calculate the capitalized cost of a project that has an initial cost of P8000000 and an additional cost of P250000 at the end of every 8 years. Our Cash Flow Diagram Generator is an excellent tool for displaying business financial results both numerically and visually. Create your business plan today.

Use this calculator tool to determine whether your present cash flow is enough to cover your needs for payroll loan payments inventory purchases and any other financial draws on your business resources. Operating cash flow Net income Non-cash expenses Increases in working capital. PPE is impacted by Capex.

Simple online software makes it easy. Operating cash flow formula. To get started with our Cash Flow Diagram generator ChartExpo follow the simple steps below.

Cash flow forecast Beginning cash Projected inflows Projected outflows. Once the ChartExpo-Best Data Visualization Tool drop-down menu shows click the Open button. For a business to be successful in the long term it needs to generate profits while also being cash flow positive.

A calculator will give you a detailed report about the present value of your future cash flows. Uniform Series Sinking Fund. Uniform Series Compound Amount.

PV23000 Payment is done in 3 equal payment Rate of interest 425 Duration 6 years. It helps you build a forecast of the money coming in and going out of your business for the next 1 to 3 months. The cash flow chart calculates future cash flow based on.

Rationale for Graphic Representation Most business owners utilize a variety of programs and spreadsheets to forecast calculate and record the results of their business activities. What three equal payments one in 2 years one in 4 years and. Install ChartExpo for Google Sheets.

Knowing your cash flow from operations is a must when getting an accurate overview of your cash flow. Revenue and income is enough to cover your financial obligations ie. By changing any value in the following form fields calculated values are immediately provided for displayed output values.

These cash flows can be fixed or changing. Open the worksheet and click Extensions menu. Uniform Series Present Worth.

Thats because the FCF formula doesnt account for. When it comes to your business accounting there are a number of different formulas. The future value is the amount that will be received at the end of a certain period.

Cash Flow Diagrams Present Or Future Value Of Several Cash Flows Engineering Economics Youtube

Calculation Of Internal Rate Of Return Using A Cash Flow Diagram Youtube

Npv Calculator Irr And Net Present Value Calculator For Excel

Understanding Cash Flow Diagram Stress Proof Your Money

For What Value Of P In The Cash Flow Diagram Does The Present Value Equal 0 When Marr Is 6 A 5490 B 5540 C 5600 D 5640 Study Com

Present Value Of Cash Flows Calculator

Solved A Calculate The Irr For Each Of The Three Cash Flow Chegg Com

Using A Cash Flow Diagram For Calculation Of Net Present Value Youtube

Ch6a Annual Cash Flow Analysis Part I Youtube

Understanding Cash Flow Diagrams Present And Future Value Youtube